These terms will help you stay on top of your investments and feel a lot more at ease with financial lingo. Learning a few of the top investment terms can help make you more comfortable in understanding where your money is going. You can take advantage of the benefits of dollar cost averaging by setting up automated contributions to your Schwab Intelligent Portfolios account.Diving into the world of investing can seem intimidating, but you don’t need to be an expert to start growing your wealth. By dollar cost averaging into a position, an investor may be less likely to cling to a single price anchor, making it easier to buy and sell according to a predetermined plan.

There's also anchoring bias, in which an investor may refuse to sell an investment bought at a historical high because he or she thinks it's still "worth" that value. But with dollar cost averaging, you're investing smaller sums of money over time, making it easier to stomach a poorly timed investment. Behaviorial economists note that most people are inherently loss-averse-they tend to react more strongly to losses (or the prospect of them) than to gains. When you invest a large sum of money in a single trade, for example, you're more likely to feel regret if that trade turns out to be poorly timed. election results-when uncertainty drove markets downward-you may have regretted your decision in the days that followed, when the market surged to record highs.ĭollar cost averaging may also help prevent your emotions from undermining your portfolio. If you stopped investing leading up to the 2016 U.S. Recent events offer an example as to why a steady investment strategy is so important. Dollar cost averaging helps ensure that you'll be at the door when opportunity knocks.

#Dca stock lingo professional#

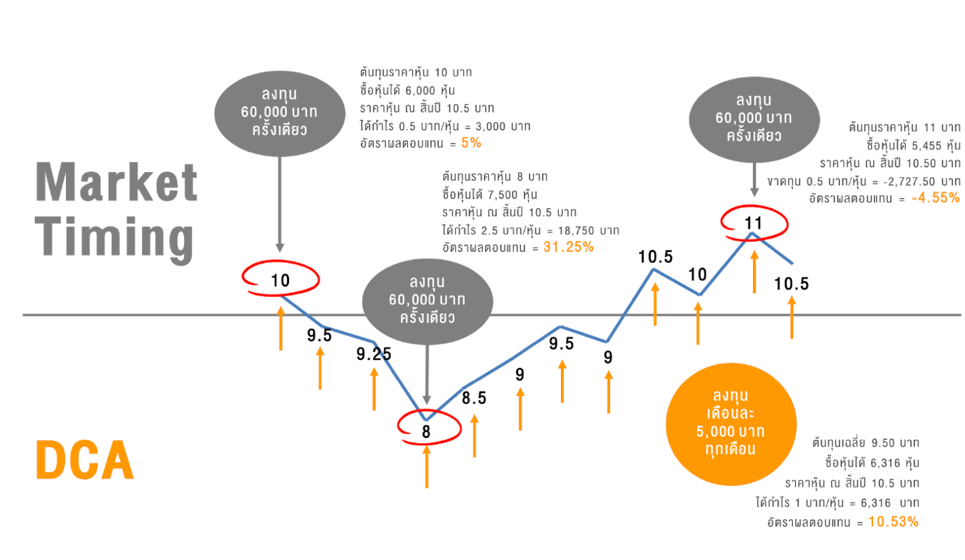

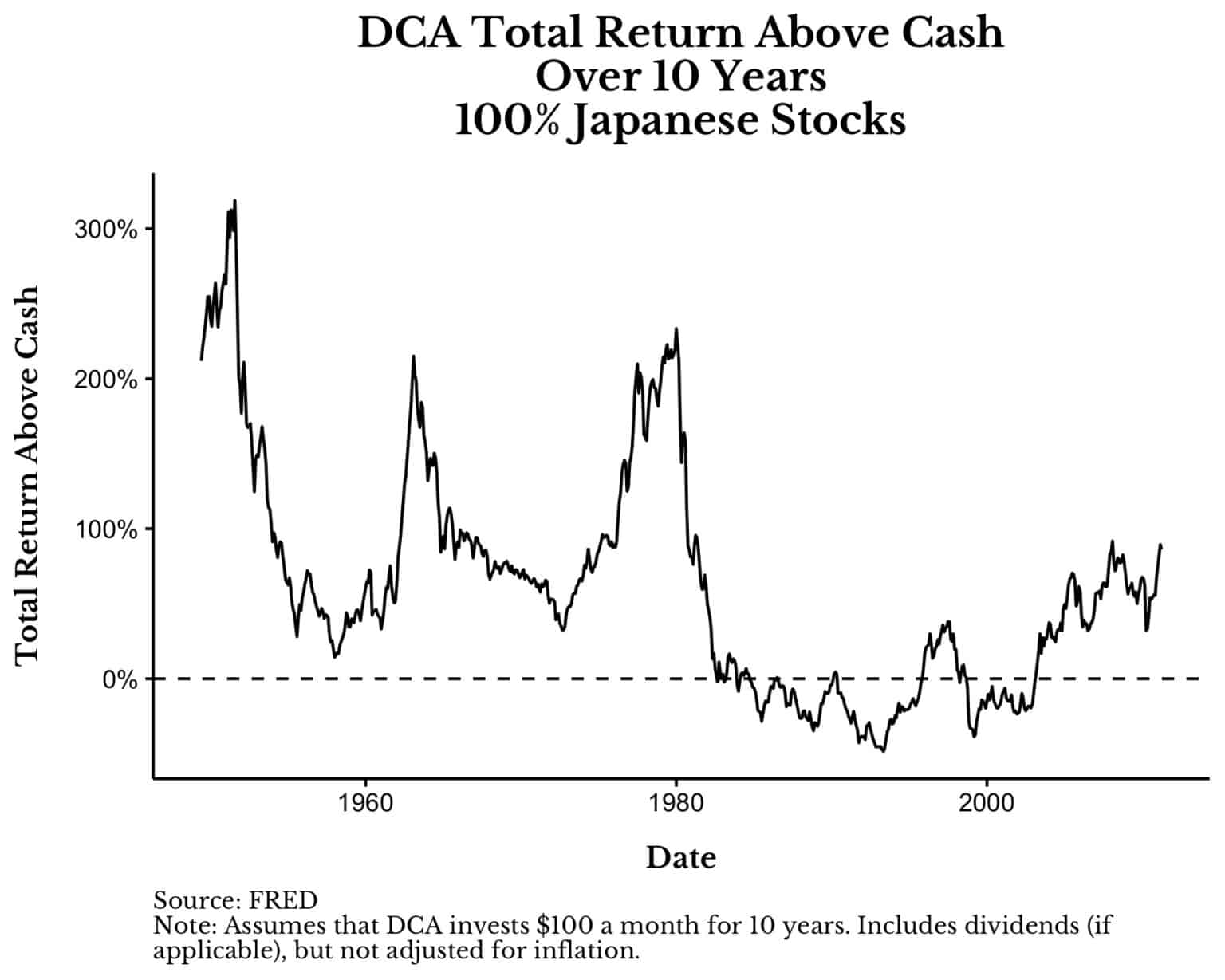

It keeps you open to opportunities. Market timing-trying to pinpoint precisely when the market will reach its peak or hit the bottom, and buying and selling accordingly-is almost impossible, even for professional investors.If you set up regular, automatic contributions, you're less likely to miss the money you invest, more likely to develop investing discipline and more likely to stick to your plan. It establishes good investing habits. Even though you know you should be investing regularly, sometimes it's tempting to spend the money earmarked for investing on other things.While potentially reducing your cost per share is one compelling reason for dollar cost averaging, there are other benefits to consider. By investing frequently and regularly over a long period of time, you're less likely to miss out on those buying opportunities. However, there was no way of knowing ahead of time that this was the best time to buy, which is why dollar cost averaging is so valuable. In a perfect world, the investor would have placed all the money in Month 3 and walked away with 250 shares. Despite paying $4 or more per share in four out of the five months, the average cost per share came out to $3.70, and the investor was able to purchase a total of 135 shares.īy contrast, had all $500 been invested in Month 1, the average cost per share would have been $5 for a total of 100 shares. The example is hypothetical and provided for illustrative purposes only.Īs you can see above, dollar cost averaging enabled our hypothetical investor to take advantage of a price decline in Month 3, significantly reducing the average cost per share. Over time, this strategy could lower your average cost per share-compared to what you would have paid if you'd bought all your shares at once when they were more expensive than the average. When the market is up, your $100 will buy fewer shares, but when the market is down, your money will buy more.

It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level-as well as your costs. It's called dollar cost averaging.ĭollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. Fortunately, there's a time-tested strategy that can help you buy more when prices are lower and less when prices are higher. However, trying to time the market-waiting for the best time to buy or sell an investment-is extremely difficult. The answer to this age-old investing question is deceptively simple: when prices are low.

0 kommentar(er)

0 kommentar(er)